Condo Insurance in and around Lincoln

Lincoln! Look no further for condo insurance

Cover your home, wisely

- Lincoln

- Hickman

- Denton

- Bennett

- Waverly

Welcome Home, Condo Owners

Life happens.. Whether damage from weight of ice, fire, or other causes, State Farm has reliable options to help you protect your unit and personal property inside against unpredictable circumstances.

Lincoln! Look no further for condo insurance

Cover your home, wisely

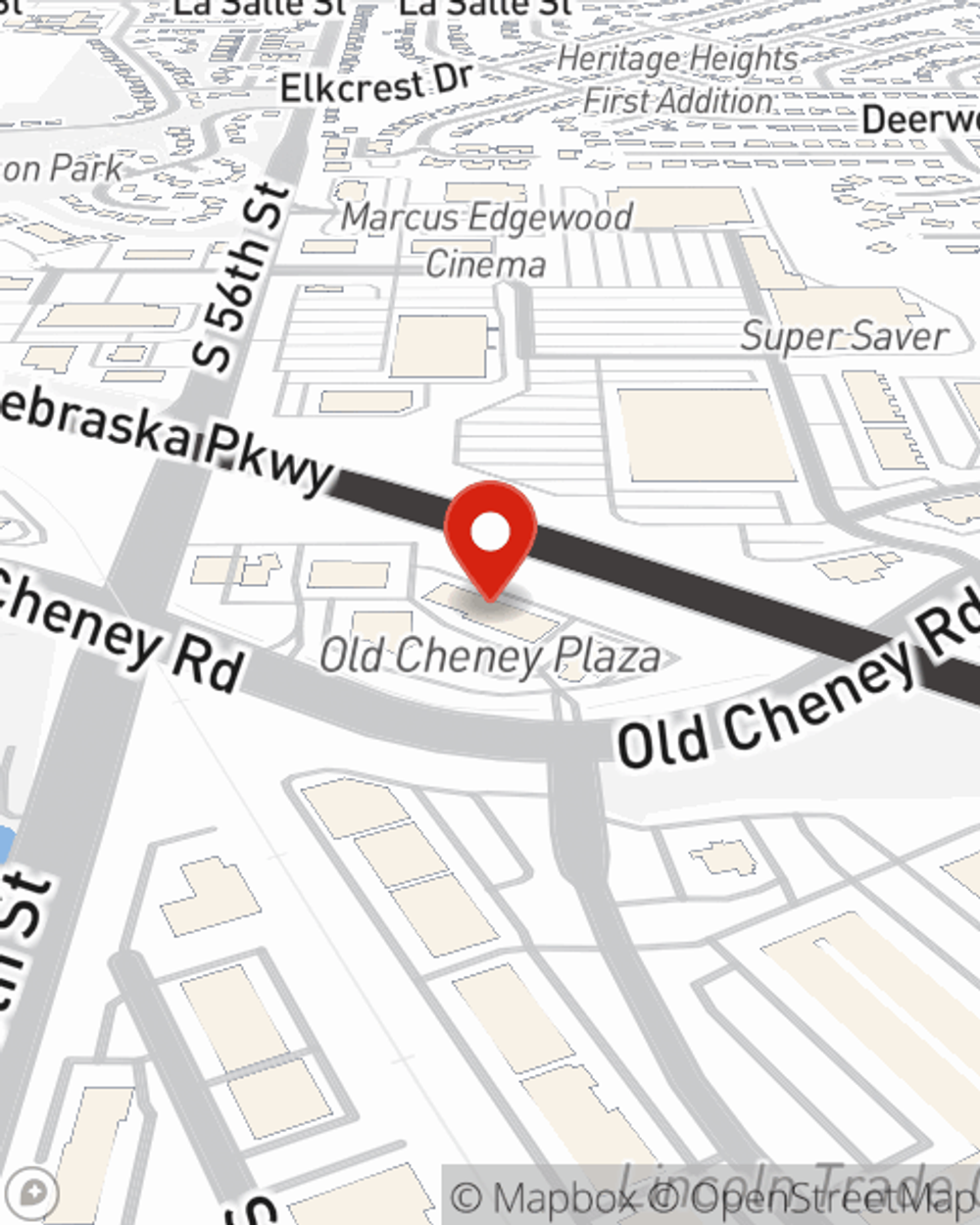

Agent Michelle Boden, At Your Service

Despite the possibility of the unpredictable, the future looks bright when you have the fantastic coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condominium and personal property inside, you'll also want to check out options for replacement costs possible discounts, and more! Agent Michelle Boden can help you generate a plan based on your needs.

If you want to learn more, State Farm agent Michelle Boden is ready to help! Simply contact Michelle Boden today and say you are interested in this fantastic coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Michelle at (402) 421-1100 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Michelle Boden

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.